Efforts Underway to Establish a State Historic Tax Credit

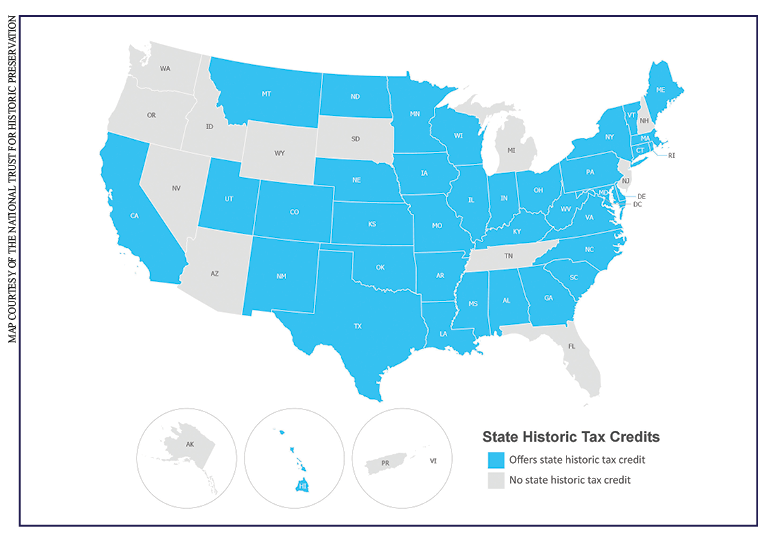

A coalition of preservation advocates and architects, led by Ashley Cates, Executive Vice-President of the AIA Tennessee and supported by the National Trust for Historic Preservation, is building on a previous bill from the last legislative session that would establish a state historic tax credit in Tennessee for commercial properties. In the current draft bill, the state credit would be available statewide, but would provide more benefits for investment in historic properties in the most rural parts of the state. Currently every state surrounding Tennessee has a state historic tax credit that typically works in concert with the federal historic tax credit program. Tennessee is one of only thirteen states in the US without a state historic tax credit.