Federal Historic Tax Credit Program

Since the Federal Historic Tax Credit program began, more than 50,000 projects have been rehabilitated across the country, generating nearly $100 billion in private investment in historic buildings nationwide. In Tennessee, buildings of almost every size and type imaginable have benefited from the Federal Historic Tax Credit (HTC) program, including bed and breakfasts, hotels, shotgun houses, former hospitals, and factory and mill complexes. Today, over 1,000 buildings in Tennessee have been rehabilitated using the ITC program, generating over $1.5 billion in investments in Tennessee's historic buildings.

The program provides a 20% historic tax credit for certified historic structures. In order to become certified, projects must be reviewed by the State Historic Preservation Office and the Technical Preservation Services division of the National Park Service (NPS). Applicants should contact the Tennessee Historical Commission (THC) before starting a project.

As of August 15, 2023, all historic preservation certification applications must be submitted electronically, both new applications submitted to State Historic Preservation Offices (SHPOs) and materials submitted to the NPS in response to requests for additional information.

National Park Service - Technical Preservation Services has issued revised Historic Preservation Certification Application forms and instructions, dated "Rev. 6/2023."

The forms continue to be downloadable, fillable PDFs. The only change to the forms is the removal of the requirement for the applicant and NPS staff to “sign in ink.” Applicants will sign the application cover sheet electronically (see link above for information on types of accepted e-signatures). NPS staff will also sign the forms electronically, and NPS decisions will be issued electronically.

The National Park Service have developed file and photo naming conventions and instructions on organizing files for electronic submission. All electronically submitted applications must follow these conventions and instructions. Applicants should download these PDF files for reference in preparing materials for electronic submission.

Applications may be submitted electronically to the Tennessee State Historic Preservation Office (TN-SHPO) by completing the online information here. Instructions on how to submit required supporting documentation is included.

Program Eligibility Requirements

There are four factors that can help you decide whether your rehabilitation project would meet the basic requirements for the 20% tax credit.

Buildings may be listed individually in the National Register of Historic Places or as a part of a historic district. You can check by searching for your address on the Tennessee Historical Commission Viewer, or by searching our Tennessee National Register Listings spreadsheet to find out if your building is listed. If you are having trouble determining if your property is listed in the National Register, please contact our National Register Staff.

If your property is located in a National Register district or a certified state or local district, it still must be designated by the National Park Service as a structure that retains historic integrity and contributes to the historic character of the district, thus qualifying as a "certified historic structure." Not every building in a district is contributing. When historic districts are designated, they are usually associated with a particular time period or "period of significance," such as "mid-1800s to 1935." In such a district, a 1950 office building would not contribute and would not be eligible for a 20% rehabilitation tax credit.

You can request the National Park Service to designate your building a "certified historic structure" by completing and submitting Part 1 of the Historic Preservation Certification Application.

Learn more about the application process.

In brief, this means that the cost of rehabilitation must exceed the pre-rehabilitation cost of the building. Generally, this test must be met within two years or within five years for a project completed in multiple phases.

The cost of a project must exceed the greater of $5,000 or the building’s adjusted basis. The following formula will help you determine if your project will be substantial:

- A — B — C + D = adjusted basis

- A = purchase price of the property (building and land)

- B = the cost of the land at the time of purchase

- C = depreciation taken for an income-producing property

- D = cost of any capital improvements made since purchase

For example, Mr. Jones has owned a small Victorian rental cottage for a number of years. He originally purchased the property for $150,000 and, of that purchase price, $70,000 was attributed to the cost of the land. Over the past years, he has depreciated the building for tax purposes by a total of $41,000. He recently replaced the air conditioning system at a cost of $1,500. Therefore, Mr. Jones’s adjusted basis is $40,500 (or 150,000 — 70,000 — 41,000 + 1,500).

Mr. Jones intends to spend $50,000 to install a new roof, repair rotten siding, upgrade the wiring, and rebuild the severely deteriorated front porch, which will qualify as a substantial rehabilitation project. If he completes the application process and receives certification from the National Park Service that the rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation, Mr. Jones will be eligible for a 20% credit on the cost of his rehabilitation, or a $10,000 credit.

Some expenses associated with a project may not qualify for the tax credit, such as a new rear addition, new kitchen appliances, and landscaping.

Learn more about qualified rehabilitation expenses from the IRS.

These are ten principles that, when followed, ensure the historic character of the building has been preserved in the rehabilitation. The Standards are applied to projects in a reasonable manner, taking into consideration economic and technical feasibility.

Learn more about the Standards for Rehabilitation.

The 20% credit is available only to properties rehabilitated for income-producing purposes, including commercial, industrial, agricultural, rental residential or apartment use. The credit cannot be used to rehabilitate your private residence.

However, if a portion of a personal residence is used for business, such as an office or a rental apartment, in some instances the amount of rehabilitation costs spent on that portion of the residence may be eligible for the credit.

Additional factors and conditions can determine whether a potential project is eligible for the 20% tax credit.

- Buildings, not structures. Although the National Register of Historic Places lists structures, objects, and sites in addition to buildings, the 20% rehabilitation tax credit is only available for buildings. Treasury Regulation 1.48-1(e) defines a building as any structure or edifice enclosing a space within its walls, and usually covered by a roof, the purpose of which is, to provide shelter or housing, or to provide working, office, parking, display, or sales space.

- Physical integrity. The 20% tax credit for historic preservation is meant to preserve historic buildings, and not to create buildings that look old, but that are in effect new buildings. Thus, the credit is not available if the building does not have sufficient historic material to preserve at the outset of the rehabilitation. Once the integrity of a building has been lost due to deterioration, damage, or previous alterations, it can never be regained. While new material can exactly copy significant features, material integrity itself can never be re-created. It is important to select a building for rehabilitation that retains its basic physical integrity before rehabilitation.

- Non-historic surface coverings. Some historic buildings have been covered with non-historic surface coverings that obscure the building underneath. In these cases, it will be necessary to remove the covering to make sure that there is enough historic building material remaining that the building still qualifies as historic.

- Multiple buildings. Farms, mills, and other historic properties often have more than one building. For properties with multiple buildings that were functionally related historically, the rehabilitation certification decision will be based on the effect of the overall rehabilitation on the entire property, and not on each structure or individual component.

- Moved buildings. Moving a historic building can jeopardize its listing in the National Register of Historic Places, and special procedures must be followed to ensure its continued listing. Likewise, moving a building into or within a historic district may jeopardize its ability to contribute to the significance of the district. If a building will be moved as part of the rehabilitation project, consult with the SHPO as soon as possible.

- Demolition. Projects that involve demolition require careful planning to ensure approval whether whole buildings will be demolished or only parts of a structure.

The recent webinar by the National Trust for Historic Preservation's Preservation Leadership form titled "Coronavirus Response: The Historic tax Credit as an Economic Recovery Tool" showed how beneficial the Historic Tax Credits are.

Crosstown Concourse, the former regional Sears retail and distribution center, is one of the largest certified rehabilitation in Tennessee.

Clayborn Temple, an important building in the 1968 sanitation worker strikes in Memphis is listed in the National Register for its national significance. It is currently undergoing rehabilitation after years of being vacant.

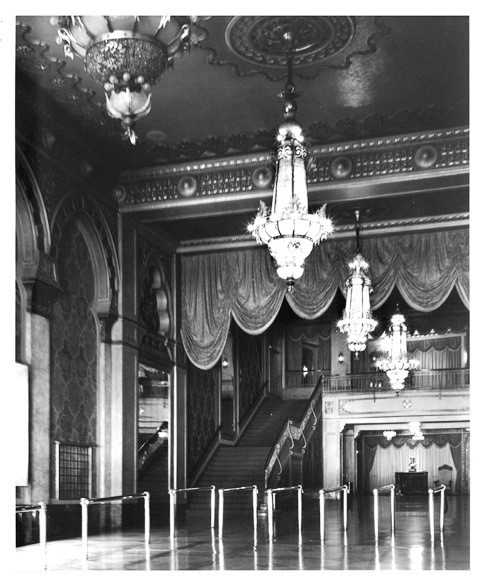

Above, left: An image from an issue of Traditional Building, which had a full page advertisement for lighting in Knoxville's Tennessee Theater. The property was listed in the National Register as the Burwell Building Tennessee Theater in 1982 (photo above, right from NR nomination) and owners took advantage of the ITC in 2005. The theater is now a vibrant part of downtown Knoxville.

| Contact |

|---|

| Justin Heskew Historic Preservation Supervisor and Historic Tax Credit Reviewer Justin.Heskew@tn.gov - Email to receive an application and instructions for the HTC program (615) 770-1098 |