1099-G Questions for Tax Year 2023

1099-G Update

1099-G forms for tax year 2023 are no longer available online. The state mailed forms to individuals on January 31. If you have a question about your form, call the 1099-G Information Line at (844) 500-4906.

February 13, 2024

If you received unemployment benefits in 2023, you will receive a 1099-G tax form from the state of Tennessee.

Unemployment insurance payments are taxable.

When you file for unemployment, you have the option to choose to have taxes taken out at the time benefits are paid. If you opt to have the deductions taken out of your unemployment benefits, the standard deduction used is 10% for Federal Taxes.

How to find and download your 1099-G tax form

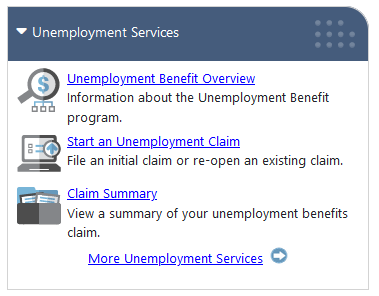

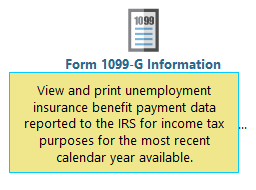

You can quickly download your tax form from the dashboard of your Jobs4TN.gov account. Depending on your chosen 1099-G delivery method, you may also receive the form through the United States Postal Service.

Click on the "1099-G Information" dropdown button below for more information on finding your form at Jobs4TN.gov.

Helpful tips:

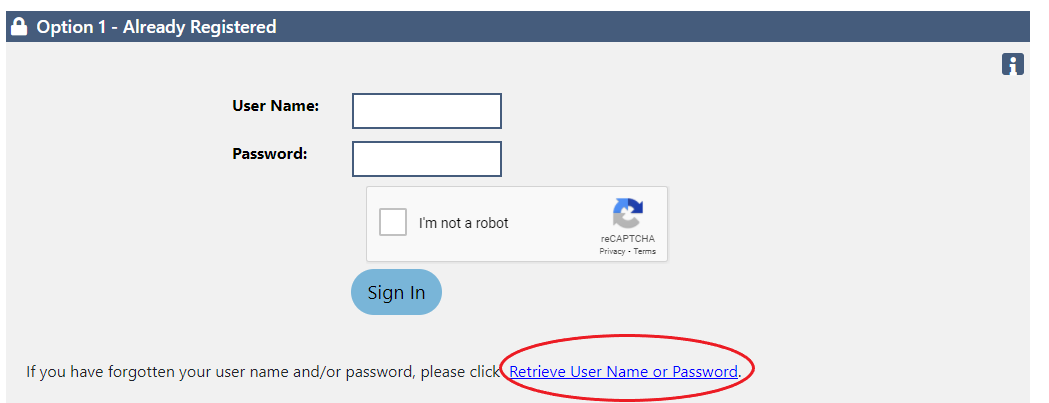

If you do not remember the password to your Jobs4TN.gov account

Once you navigate to the sign-in page on Jobs4TN.gov, underneath the box where you enter your username and password, you will see a link that reads “Retrieve Username or Password”. Follow that link to reset your password.

If you think the information on your 1099-G form is incorrect

After reviewing your tax form, if you feel the information is incorrect, you can call the Department’s 1099-G Information Line at (844) 500-4906. Agents can only answer questions regarding your 1099-G form.

If you received unemployment benefits in 2023 but you did not receive a 1099-G form

If you received unemployment benefits in 2023 but did not find a 1099-G form on your account dashboard or through your preferred communication method by January 31, 2024, please call the 1099-G Information Line at (844) 500-4906 to notify the Department of this issue. Agents can only answer questions regarding your 1099-G form.

If you received a 1099-G form but you did not receive unemployment benefits in 2023

If you received a tax form, but you did not receive unemployment benefits in 2023, your personal information may have been compromised. Please call the 1099-G Information Line at (844) 500-4906 to notify the Department of this issue. Agents can only answer questions regarding your 1099-G form.

If you think someone has used your Social Security number to file for unemployment benefits

The IRS has prepared action steps you can take if you think someone has used your Social Security number to file for benefits.

If you believe you are the victim of identity theft

Criminals are quick to take advantage of an opportunity to steal, and increased unemployment benefits have provided that opportunity. If you received a 1099-G form, which leads you to believe you are the victim of identity theft, the Internal Revenue Service has provided resources to help you navigate this issue. You will find detailed information on what steps you should take by accessing the following links:

Tennessee Department of Labor and Workforce Development's

1099-G Information Line

(844) 500-4906

This Page Last Updated: April 26, 2024 at 2:39 PM