Eligible Applicants

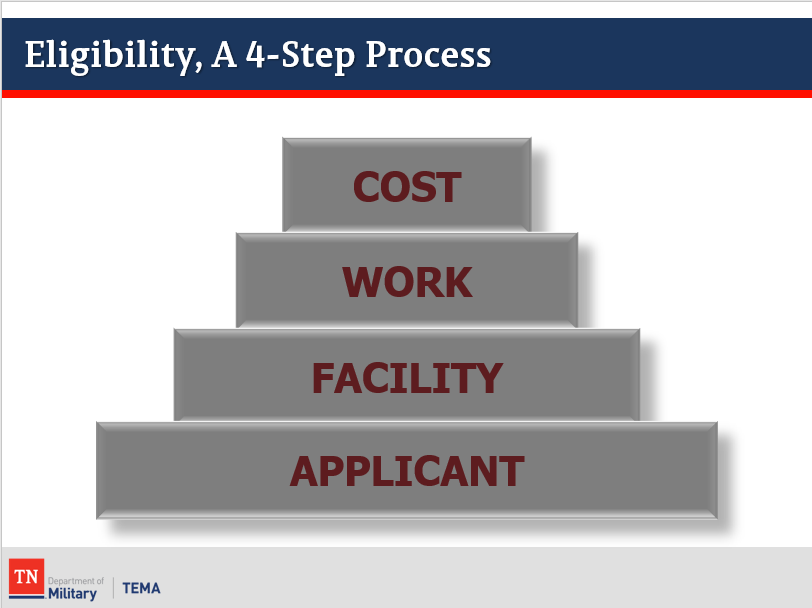

The first step in FEMA’s review of eligibility begins with the Applicant. Eligible Applicants include state, territorial, tribal, and local governments, as well as certain private non-profit organizations. The following provide expanded information on each of the eligible classifications of applicants.

FEMA Policy describes eligibility for State and Territorial governments also include the District of Columbia, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, and the U.S. Virgin Islands.

Eligible applicants under this category include Federally recognized Indian Tribal governments, including Alaska Native villages and organizations. Alaska Native Corporations are ineligible as they are privately owned.

The following types of local governments are eligible applicants.

• Counties and parishes

• Municipalities, cities, towns, boroughs, and townships

• Local public authorities

• School districts

• Intrastate districts

• Councils of governments

• Regional and interstate government entities

• Agencies or instrumentalities of local governments

• State-recognized Tribes

• Special districts established under State Law

Community Development Districts are special districts that finance, plan, establish, acquire, construct or reconstruct, operate, and maintain systems, facilities, and basic infrastructure within their respective jurisdictions. To be eligible, a Community Development District must own and be legally responsible for maintenance, and operation of an eligible facility that is open to and serves the general public.

The State or a political subdivision of the State may submit applications on behalf of rural communities, unincorporated towns or villages, and other public entities not listed above.

Only certain Private Non-Profit (PNP) Organizations are eligible Applicants. To be an eligible PNP Applicant, the PNP must show that it meets the tax-exempt status and own or operate an eligible facility/service. The following will provide clarification on how these are met.

Tax-Exempt Status

Tax-Exempt Status can be proven through one of two ways: (1) a current ruling letter from the U.S. Internal Revenue Service granting tax exemption under sections 501(c), (d), or (e) of the Internal Revenue Code of 1954; or (2) documentation from the State substantiating it is a non-revenue producing, nonprofit entity organized or doing business under State law.

Eligible Services

Critical, Non-Critical and Non-Eligible Services

Eligible Services are defined as either: (1) a facility that provides a critical service, which is defined as education, utility, emergency, or medical; or (2) a facility that provides a non-critical, but essential social service AND provides those services to the general public.

Serving the General Public

PNP facilities generally meet the requirement of serving the general public if ALL the following conditions are met:

- Eligible PNP Facilities does not limit any of the following: a certain number of individuals; a defined group of individuals who have a financial interest in the facility, such as a condominium association; certain classes of individuals; or an unreasonably restrictive geographical area, such as a neighborhood within a community.

- Facility access is not limited to a specific population (such as those with gates or other security systems intended to restrict public access); and

- Any membership fee meets all of the following: are nominal; are waived when an individual can show inability to pay the fee; are not of such magnitude to preclude use by a significant portion of the community; and do not exceed what is appropriate, based on other facilities used for similar services.

Certain types of facilities, such as senior centers, that restrict access in a manner clearly related to the nature of the facility, are still considered to provide essential social services to the general public.

In cases where the facility provides multiple services, such as a community center, FEMA reviews additional items to determine the primary service that a facility provides.

Facilities established or primarily used for political, athletic, recreational, vocational, or academic training, conferences, or similar activities are not eligible.