Public Assistance

The Federal Emergency Management Agency's (FEMA) Public Assistance program provides supplemental grants to eligible applicants to aide community response and recovery following presidentially declared disasters.

The four basic components of Public Assistance eligibility are applicant, facility, work, and cost.

Who is Eligible?

- Counties and local jurisdictions within those counties that are included in the Federal Declaration.

- State government agencies that assisted in the declared counties.

- Private non-profit (PNP) organizations that own or operate facilities that provide certain services otherwise performed by a government agency. Information on what qualifies as a PNP can be found on FEMA's website.

- Houses of Worship.

For more detailed information about FEMA's Public Assistance program, visit their website.

Applicant Briefings

As a result of the April 2-24, 2025 severe weather, eligible entities are required to attend an applicant briefing if they plan to submit a FEMA Request for Public Assistance (RPA). The current deadline to submit a RPA is July 19, 2025. At these briefings, information will be presented on becoming an applicant, eligibility, and documentation. TEMA staff will go over program requirements, special issues, payments, final inspections, and closeout. If your organization needs assistance submitting an RPA, please email TEMA.PA@tn.gov. Please note, if assistance is requested to submit an RPA, eligible applicants are still required to attend the applicant briefing.

Below are the days and locations of applicant briefings:

West Region

Monday, July 7, 2025, 1:00 p.m. CT | Tipton County EMA Office, 8629 Hwy 51 S, Brighton, TN 38011

Tuesday, July 8, 2025, 9:00 a.m. CT | Gibson County EMA Office, 1246 Manufactures Row, Trenton, TN 38382

Tuesday, July 8, 2025, 1:00 p.m. CT | Madison County EMA Office, 239 Grady Montgomery Dr, Jackson, TN 38301

Wednesday, July 9, 2025, 9:00 a.m. CT | Hardin County 911/EOC, 90 S Riverside Dr, Savannah, TN 38372

Middle Region

Tuesday, July 8, 2025, 10:00 a.m. CT | Stewart County EMA Office, 117 Donelson Pkwy, Dover, TN 37058

Wednesday, July 9, 2025, 10:00 a.m. CT| Metro Nashville OEM, 2060 15th Ave, Nashville, TN 37211

Thursday, July 10, 2025, 10:00 a.m. CT| Hickman County EMA Office, 550 SR 100, Hickman, TN 37033

East Region

Monday, July 7, 2025, 1:00 p.m. ET | Tracy City City Hall, 50 Main Street, Tracy City, TN 37387

Next Steps

After attending an applicant briefing, you will need to fill out the following forms to become an applicant.

Once you have completed these forms, please email them to TEMA.PA@tn.gov.

FEMA-4832-DR-TN, Tropical Storm Helene

Declaration Date: October 2, 2024

Incident Period: September 26, 2024- Ongoing

Declared Counties: Carter, Claiborne, Cocke, Grainger, Greene, Hamblen, Hawkins, Jefferson, Johnson, Sevier, Sullivan, Unicoi, and Washington counties

Request for Public Assistance Deadline: November 1, 2024

Small Project Threshold: $1,062,900

Minimum Project Amount: $4,000

Periods of Performance: Automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

Project Types |

Automatic |

TEMA Authority |

FEMA Authority |

Emergency Work Category A-B |

6 Months April 2, 2025 |

6 Months October 2, 2025 |

Longer |

Permanent Work Categories C-G |

18 Months April 2, 2026 |

48 Months October 2, 2028 |

Longer |

FEMA-4792-DR-TN, Severe Storms, Tornadoes, and Flooding

Declaration Date: June 17, 2024

Incident Period: May 8-9, 2024

Declared Counties: Cannon, Cheatham, Giles, Hamilton, Jackson, Macon, Maury, Montgomery, Polk, Smith, Sumner, and Warren counties

Request for Public Assistance Deadline: July 17, 2024

Small Project Threshold: $1,032,000

Minimum Project Amount: $3,900

Periods of Performance: Automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

Project Types |

Automatic |

TEMA Authority |

FEMA Authority |

Emergency Work Category A-B |

6 Months December 17, 2024 |

6 Months June 17, 2025 |

Longer |

Permanent Work Categories C-G |

18 Months December 17, 2025 |

48 Months June 17, 2028 |

Longer |

FEMA-4751-DR-TN, Severe Storms, Straight-line Winds, and Tornado

Declaration Date: December 13, 2023

Incident Period: December 9, 2023

Declared Counties: Cheatham, Davidson, Dickson, Gibson, Montgomery, Robertson, Stewart, Sumner, and Weakley counties

Request for Public Assistance Deadline: February 29, 2024

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

Periods of Performance: Automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

Project Types |

Automatic |

TEMA Authority |

FEMA Authority |

Emergency Work Category A-B |

6 Months June 12, 2024 |

6 Months December 12, 2024 |

Longer |

Permanent Work Categories C-G |

18 Months June 12, 2025 |

48 Months December 12, 2027 |

Longer |

FEMA-4742-DR-TN, Severe Storms, Straight-line Winds, and Tornado

Declaration Date: September 27, 2023

Incident Period: August 7, 2023

Declared Counties: Bledsoe, Coffee, Cumberland, Jefferson, Knox, Loudon, Meigs, Rhea, Roane, and Van Buren Counties

State Agencies: Applicant Registration Form

East Tennessee: Applicant Registration Form - East

Request for Public Assistance (RPA) Deadline: October 26, 2023

Important: Submit RPA in FEMA Grants Portal to become an Applicant. This is the only method by which an entity or organization may be eligible to participate in the Public Assistance Program. Go to: https://grantee.fema.gov/

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

Periods of Performance: In the below table, automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

| Project Types | Automatic | TEMA Authority | FEMA Authority |

|---|---|---|---|

| Emergency Work Categories A-B |

6 Months March 26, 2024 |

6 Months September 26, 2024 |

Longer |

| Permanent Work Categories C-G |

18 Months March 26, 2025 |

48 Months September 26, 2027 |

Longer |

FEMA-4735-DR-TN, Severe Storms and Straight-line Winds

Declaration Date: September 4, 2023

Incident Period: July 18-21, 2023

Declared Counties: Fayette, Henry, Shelby and Tipton Counties

West Tennessee and State Agencies: West TN - Applicant Registration Form

Request for Public Assistance (RPA) Deadline: October 4, 2023

Important: Submit RPA in FEMA Grants Portal to become an Applicant. This is the only method by which an entity or organization may be eligible to participate in the Public Assistance Program. Go to: https://grantee.fema.gov/

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

Periods of Performance: In the below table, automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

| Project Types | Automatic | TEMA Authority | FEMA Authority |

|---|---|---|---|

| Emergency Work Categories A-B |

6 Months March 3, 2024 |

6 Months September 3, 2024 |

Longer |

| Permanent Work Categories C-G |

18 Months March 3, 2025 |

48 Months September 3, 2027 |

Longer |

FEMA-4729-DR-TN, Severe Storms and Straight-line Winds

Declaration Date: August 17, 2023

Incident Period: June 25-26, 2023

Declared Counties: Fayette, Shelby and Tipton Counties

West Tennessee and State Agencies: Applicant Registration Form

Important: Submit RPA in FEMA Grants Portal to become an Applicant. This is the only method by which an entity or organization may be eligible to participate in the Public Assistance Program. Go to: https://grantee.fema.gov/

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

Periods of Performance: In the below table, automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

| Project Types | Automatic | TEMA Authority | FEMA Authority |

|---|---|---|---|

| Emergency Work Categories A-B |

6 Months February 16, 2024 |

6 Months August 16, 2024 |

Longer |

| Permanent Work Categories C-G |

18 Months February 16, 2025 |

48 Months August 16, 2027 |

Longer |

FEMA-4701-DR-TN, Severe Storms, Straight-line Winds, and Tornadoes

Declaration Date: April 7, 2023

Incident Period: March 31-April 1, 2023

Declared Counties: Cannon, Giles, Hardeman, Hardin, Haywood, Johnson, Lewis, Macon, McNairy, Morgan, Rutherford, Tipton, and Wayne

FEMA Request for Public Assistance Deadline: May 6, 2023

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

The eligibility for Public Assistance in this declaration is varied. To help with understanding what type of assistance is available, please see the attached Declared Counties and Programs. More will be explained during the Applicant Briefings.

Periods of Performance: In the below table, automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

| Project Types | Automatic | TEMA Authority | FEMA Authority |

|---|---|---|---|

| Emergency Work Categories A-B |

6 Months October 6, 2023 |

6 Months April 6, 2024 |

Longer |

| Permanent Work Categories C-G |

18 Months October 6, 2024 |

48 Months April 6, 2027 |

Longer |

FEMA-4712-DR-TN, Severe Storms, Straight-line Winds, and Tornado

Declaration Date: May 17, 2023

Incident Period: March 1-3, 2023

Declared Counties: Benton, Bledsoe, Campbell, Caroll, Cheatham, Clay, Crockett, Davidson, Decatur, Dickson, Fentress, Gibson, Giles, Grundy, Hamilton, Hardin, Haywood, Henderson, Henry, Hickman, Houston, Humphreys, Jackson, Lake, Lauderdale, Lawrence, Lewis, Macon, Madison, Marion, Meigs, Monroe, Montgomery, Moore, Obion, Perry, Pickett, Polk, Rhea, Robertson, Stewart, Sumner, Tipton, Wayne, and White Counties

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

Periods of Performance: In the below table, automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

| Project Types | Automatic | TEMA Authority | FEMA Authority |

|---|---|---|---|

| Emergency Work Categories A-B |

6 Months November 16, 2023 |

6 Months May 16, 2024 |

Longer |

| Permanent Work Categories C-G |

18 Months November 16, 2024 |

48 Months May 16, 2027 |

Longer |

FEMA-4691-DR-TN, Severe Winter Storm

Declaration Date: March 8, 2023

Incident Period: December 22-27, 2022

Declared Counties: Cocke, Coffee, Davidson, Greene, Henderson, Knox, Maury, Perry, Putnam, Shelby, and Washington

Small Project Threshold: $1,000,000

Minimum Project Amount: $3,800

Periods of Performance: In the below table, automatic periods of performance are provided depending on whether the project is Emergency Work or Permanent Work. If time is still needed at the end of the awarded performance period, the State can approve a limited amount of time. After this, any time extensions must be approved by FEMA. Time Extension forms are available under the Grants Management webpage.

| Project Types | Automatic | TEMA Authority | FEMA Authority |

|---|---|---|---|

| Emergency Work Categories A-B |

6 Months September 7, 2023 |

6 Months March 7, 2024 |

Longer |

| Permanent Work Categories C-G |

18 Months September 7, 2024 |

48 Months March 7, 2027 |

Longer |

FEMA-4514-DR-TN, January 20, 2020 to May 11, 2023 - COVID-19 Pandemic

Declaration Date: April 2, 2020

Declared Counties: Statewide – All Counties

Deadline for Submitting Request for Public Assistance: June 30, 2022

Deadline for submitting eligible costs from January 20, 2020, to June 30, 2022: December 31, 2022

COVID-19 Programmatic Deadlines Policy V2

Training Videos: The following links are to training videos that FEMA has developed to assist applicants through the streamlined application process.

www.youtube.com/channel/UCIJp91Ds2IaVlR1t8uXcEKg/videos

COVID-19 Guidance: Procurements Under FEMA Awards During Period of Emergency or Exigency

This online tutorial will help participants understand how to properly contract during emergency or exigent circumstances when using federal funds.

www.youtube.com/watch?v=SdlNKNvu_uw

Small Project Threshold: $131,100

Minimum Project Amount: $3,300

Resources

• Public Assistance Program and Policy Guide, April 2018

• 2019 Schedule of Equipment Rates

Application and Process Guidance

Applicant Quick Guide COVID-19 Process Review

Applicant Quick Guide Grants Portal Account and RPA

Applicant Quick Guide Completing and Submitting a COVID-19 Project Application

Clarification on Eligible Public Assistance Program Labor Costs for COVID-19

Completing and Submitting a COVID-19 Project Application

COVID-19 Streamlined Project Application

FEMA Job Aid COVID-19 Process Overview

FEMA Job Aid-Expedited Funding for COVID-19

FEMA Job Aid Requests for Information

Recipient Options to VIew Applicant Streamlined Project Applications

COVID Policy Guidance

FEMA Advisory-FEMA Announces ALL COVID-19 Disaster Declaration Incident Periods Will Close May 11, 2023

COVID-19 Public Assistance Eligibility Air Disinfection Final

COVID-19 Pandemic-Public Assistance (PA) Disposition Requirements for Equipment and Supplies

COVID PA Eligibility Guidance-MATRIX-FP104-009-19

FAQ on Vaccine Planning for the communities

COVID-19 Pandemic Safe Opening and Operation Work Eligible for Public Assistance Interim Policy

FP 104-009-19 PA Eligibility Policy for COVID

COVID-19 Eligibility Emergency Protective Measures Fact Sheet

COVID-19 Policy Question Provision of Water Eligibility

FEMA COVID-19 Coordinating Public Assistance and Other Sources of Federal Funding

Procurement During Emergency/Exigent Circumstances Fact Sheet

Public Assistance Medical Care Policy for COVID-19

MCEA Pandemic Planning Considerations Guide 508

COVID-19 Fact Sheet Environmental and Historic Preservation (EHP)

COVID-19 Floodplain Considerations for Temporary Critical Facilities

COVID-19 Pandemic Operational Guidance

CPOG Webinar Slides

Community Engagement Funding

Food & Nutrition

COVID-19 Purchase and Distribution of Food

Additional Guidance - Purchase and Distribution of Food Eligibility - Final

HHS Community Mitigation Task Force Sustaining Nutritional Needs for At-Risk Individuals

Information on Federal Programs to Sustain Nutrition for At-risk Individuals

Non-Congregate Sheltering

FEMA Emergency Non-Congregate Sheltering during the COVID-19 Public Health Emergency (Interim)

Official Health Order for Non-Congregate Sheltering

Non-Congregate Sheltering Request Letter to SCO

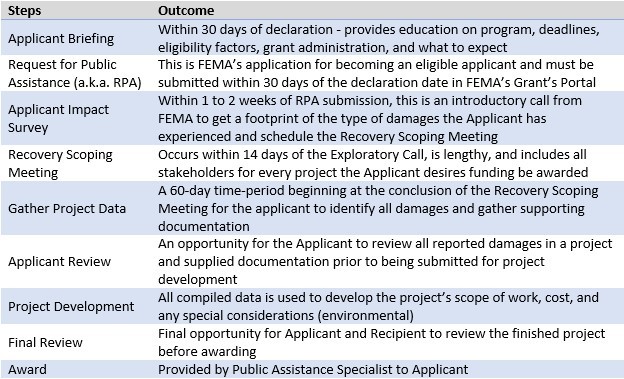

There is a timeline and sequence of events taken following a declaration to educate, gather data and documentation, and award eligible funding. The following provides a quick overview of the individual parts of the process that make up the whole.

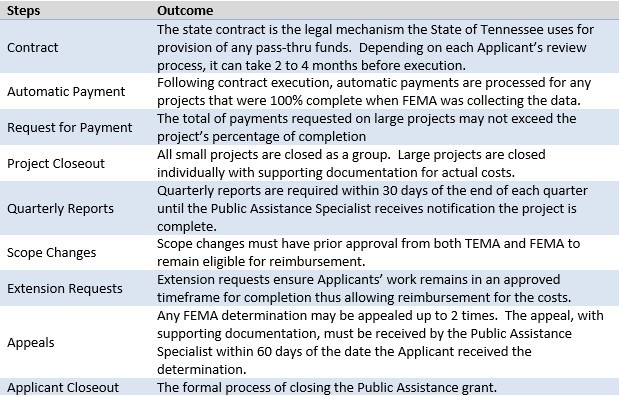

Following project awards, there is another sequence of events. The order can be different for each applicant and may not include all shown steps.

The Tennessee Emergency Management Agency, in partnership with the Federal Emergency Management Agency, made available the Grant Training Digital Series. This digital series is an opportunity to brush up on the grant writing process including research, proposal writing, administration, and budgeting.