Breaking Ground 96 - Edward Mitchell, ABLE Ambassador

by Ned Andrew Solomon, Director, Partners in Policymaking Leadership Institute, Council on Developmental Disabilities

Edward Mitchell works very hard. He recently completed his Master of Business Administration program. He’s an Independent Living Specialist at the Center for Independent Living in Jackson, Tennessee. He has a part-time job in Fan Relations for the Jackson Generals, the minor league, Double-A affiliate of the Arizona Diamondback baseball team. He also spends part of the year going around the country as a national spokesman for the ABLE (Achieving a Better Life Experience) program, a financial savings initiative designed to help individuals with disabilities put aside money to pay for qualified expenses, so they can maintain independence and enjoy a better quality of life.

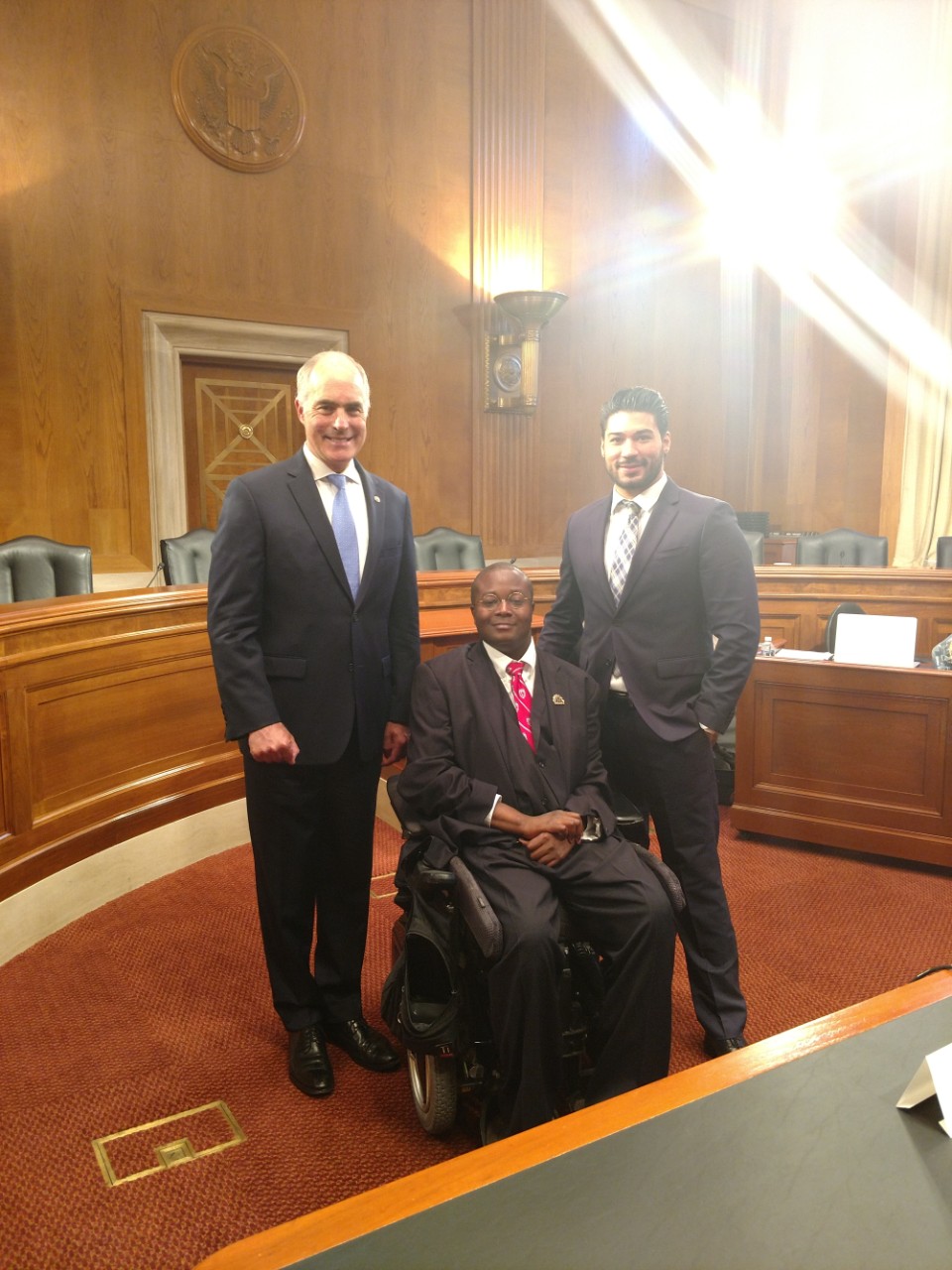

As an ABLE spokesman, Mitchell was invited to address congress last year, to talk about the struggles people with disabilities have when their income is severely restricted in order to maintain benefits. That invite came from Tennessee Senator Bob Corker, who wanted to bring in a person with a disability who’s working and someone who, according to Mitchell, was also trying to “blaze a trail”. Enter Edward.

Fifteen years ago, Mitchell was riding his bike with his younger brother. A truck crossed over the double lines and clipped him from behind, catapulting Mitchell into a ditch. He landed on his back and neck, causing an incomplete fracture to his C5- C6 vertebrae. The person driving the truck drove off and has never been found.

Mitchell is living proof that life can change in a moment. He’s also living proof that with enough gumption, you can get back to living a high-quality life, assisting others with disabilities overcome their own obstacles.

The way back

After being stabilized in Jackson General Hospital and receiving preliminary physical and occupational therapy, Mitchell’s family heard about the Shepherd Center in Atlanta, Georgia, which specializes in helping people recover from spinal cord injuries.

“My mother had an expression, ‘while others work and you play, you’ll get further and further behind’, and that was my motivation,” recalled Mitchell. “I wanted to stay with my peer group, which is why I devoted summers to going to therapies at places like the Shepherd Center.”

Mitchell also put in time at the Fraser center in Louisville, Kentucky, the Shriners Hospital in Oak Park, Chicago and the Tennessee Rehabilitation Center in Smyrna. Through his perseverance he was able to return to high school for the start of his 11th grade year at North Side High School, as well as his job with Little Caesars Pizza. “Before my accident I always came into work on time, and always completed my jobs to a satisfactory conclusion, and my boss, Kevin Colbert, knew I had the ‘make-up’ to continue and try to get back to work,” said Mitchell. “He wanted me to work like any other high school student, and he didn’t want to lose a good employee! He also had the foresight to make his place of employment truly accessible, with zero barriers. He really saw something in me and wanted me back as an employee. “

Determined to go to college, Mitchell and his parents started researching options, and contacted Tennessee’s Vocational Rehabilitation program. One particular college had its eyes on him. “The president of Lane College, Dr. Wesley Cornelius McClure, had taken a keen interest in me,” said Mitchell. “Lane College is a Historically Black College/University. President McClure said to me the Sunday after my high school graduation that Lane College is where I needed to be.”

However, none of the students at Lane had a disability like Mitchell, and the family was concerned about accessibility challenges. Dr. McClure assured Mitchell that Lane would be accessible by the time he arrived, and that he would live on campus just like other freshmen. “He was going to make it happen and that my attending Lane would also make it possible for others to attend,” Mitchell said.

As it turns out, Mitchell graduated from Lane College, magna cum laude. He followed that up with an MBA from Union University’s McAfee School of Business program.

A lifeline

“One evening my mother stumbled onto the Tennessee ABLE program,” said Mitchell. “We thought it was a lifeline. It would allow me to start saving without penalizing or jeopardizing my benefits. You see, my parents worry what will happen to me when they’re no longer able to help or they have died.”

ABLE Accounts are tax-advantaged savings accounts for individuals with disabilities and their families. The federal ABLE Act, passed in 2014, paved the way for new state programs modeled after 529 savings plans, allowing those with disabilities and their families put aside up to $14,000 a year to be used for a wide variety of disability-related costs, including living expenses. Money in these accounts do not count against a person’s $2,000 asset limit.

After signing up for an ABLE account, Mitchell applied to be an ABLE Advisor after responding to an email blast. “They were seeking ABLE account holders who could really tell their story, and what they had encountered, to help build the ABLE brand,” explained Mitchell. “There was a three-month-long interview process for that. I happened to make it down to a select few to be the first ABLE Advisor Spokesmen for the national program.”

The dilemma

Even with a Master’s degree under his belt, and acquiring work experience in a variety of settings, Mitchell still can’t accept a full salary, primarily because it would impact his nursing benefits. “I would not make enough to directly pay for nursing care, even if I gave the home care agency my entire check,” Mitchell explained. “Of course, if I did that, then how would I pay for medical expenses, car insurance, car repairs and gas? I need money to have my vehicle maintained at a dealer who is 85 miles away, the only authorized mobility dealer in the area. And, I pay a portion of my income for rent to live at home. I don’t want to put more of a burden on my family.”

With limited nursing hours – currently 27 hours - through a Medicaid waiver, Mitchell’s mother still provides at least 35 hours of his support a week. And sometimes the 27 hours aren’t used because the agency can’t locate a nurse to support Mitchell. “It would be better if individuals like myself could continue to advance in our careers without losing our benefits,” said Mitchell.

One solution is to use a special needs trust, which provides a mechanism for saving money that can be used for the benefit of the person with a disability, without affecting his or her eligibility for benefits. However, special needs trusts must be controlled by a trustee or trustees, not by the person with a disability who benefits from the trust. “Not only does this leave the individual with the disability with little control over his or her finances, it also limits the person’s independence,” said Mitchell.

ABLE accounts give individuals with disabilities the opportunity to manage a modest bank account without penalty against their eligibility for SSI, Medicaid, or other government benefits. Contributions are capped at $15,000 per year and the account cannot exceed $100,000. Funds must be used for qualified disability expenses such as housing, education, transportation, employment training, health and wellness, financial management, legal fees, and more.

Mitchell goes to Washington

That was the message that Mitchell delivered to the Senate Special Committee on Disability & Aging at the Dirksen Senate Office Building in Washington D.C. last July. The hearing was titled, “Supporting Economic Stability and Self Sufficiency as Americans with Disabilities and their Families Age”.

Mitchell had to “pass” a round of questioning from Democrats and Republicans before being selected to present. His trip was paid for by Bob Corker’s office and the ABLE National Resource Center.

To Mitchell, members of the committee seemed receptive to looking into changes to Social Security, and to addressing some of the “outdated laws that on the books”. The Council applauds Mitchell’s efforts to inform our policymakers, and hopes that through programs like ABLE, people with disabilities and their families will be able to live and work to their fullest potentials.