State Financial Overview

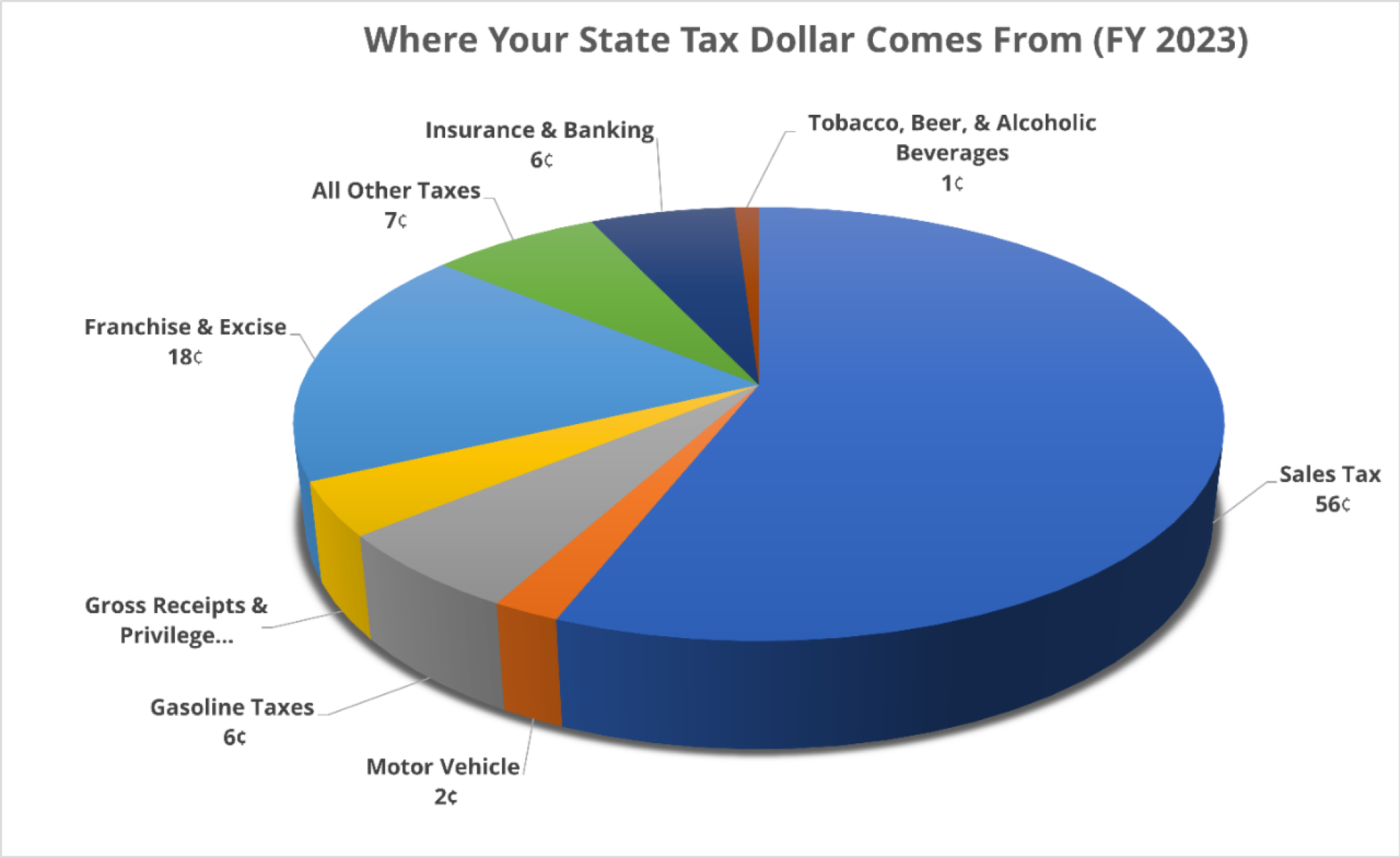

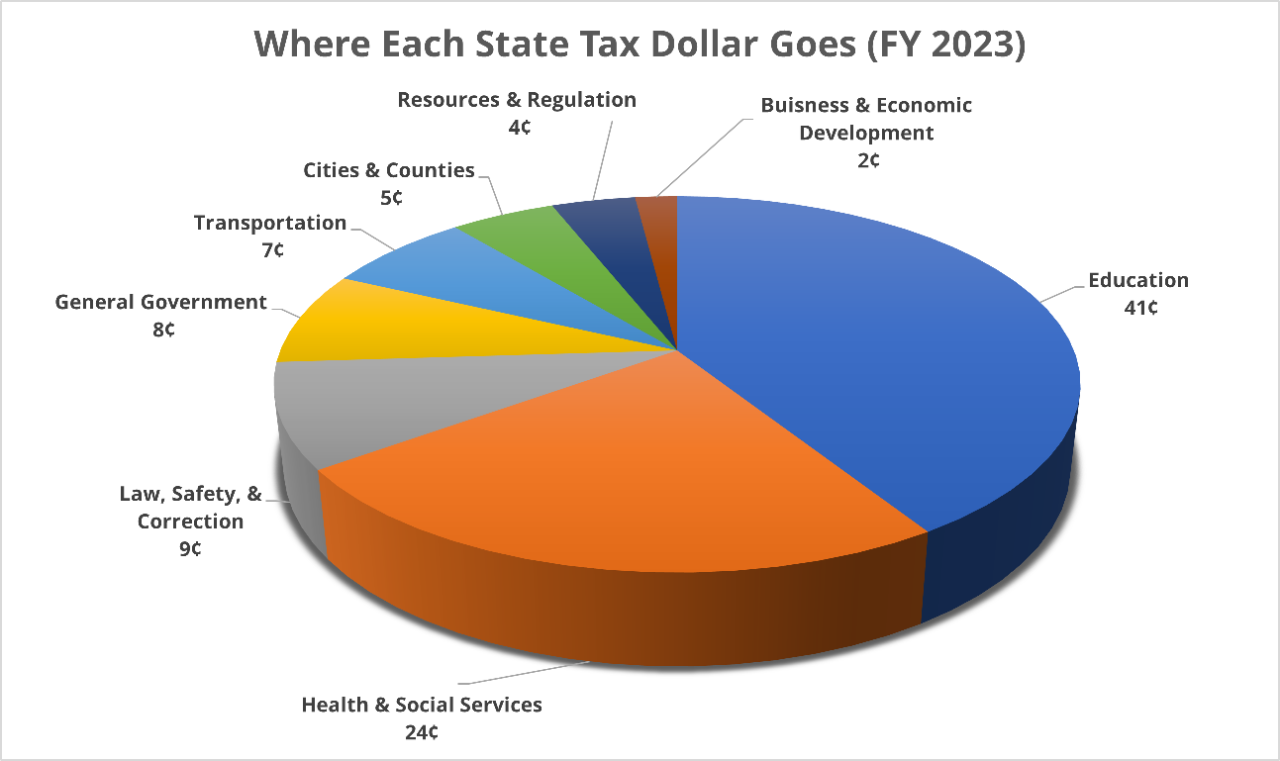

The revenues necessary to finance state government are collected from a variety of sources. The primary source of funding for state expenditures is appropriation from general revenues. General revenues are proceeds from taxes, licenses, fees, fines, forfeitures, and other imposts laid specifically by law.