CPA Evolution

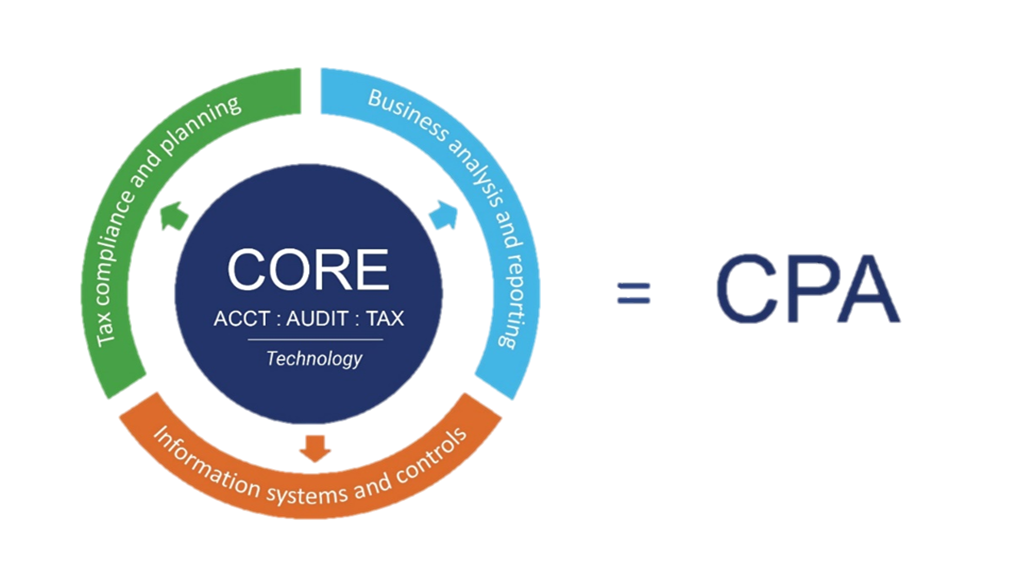

The CPA Evolution Licensure Model (CPA Evolution) establishes a foundation for the most important and relevant topics that new CPAs need to know to protect the public interest while providing an opportunity for candidates to choose one of three Disciplines as described below.

Under CPA Evolution, all candidates will be required to pass three Core Exam sections:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR

- Taxation and Regulation (REG)

Each candidate will also choose one Discipline section to demonstrate knowledge and skills in that particular domain:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

Regardless of a candidate’s chosen Discipline, CPA Evolution leads to CPA licensure, with rights, privileges, and responsibilities consistent with the present CPA license. CPA professional practice is not limited by the Discipline passed; professional standards provide guidance related to required competence and due care when performing professional services.

New Core + Discipline CPA Licensure Model

The new licensure model launched in 2024. Visit evolutionofcpa.org for more details and to view a short video demonstration.