Tennessee Employers Saving Money in 2018

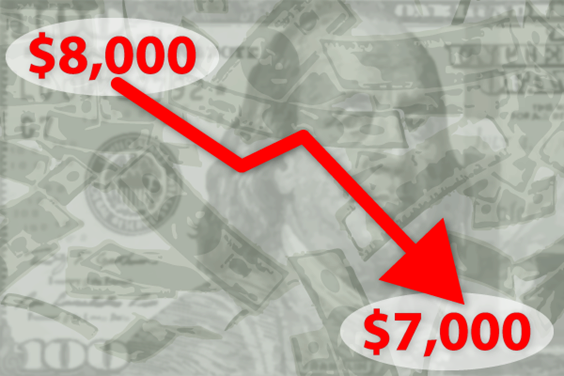

Taxable Wage Base Restored to Pre-Great Recession LevelNASHVILLE – On January 1, 2018, Tennessee employers began paying less in unemployment insurance premiums when the taxable wage base decreased from $8,000 to $7,000.

The taxable wage base is the annual amount of wages paid to an employee, which is subject to state unemployment tax.

“This will amount to a tremendous savings for each and every Tennessee employer,” said Department of Labor and Workforce Development (TDLWD) Commissioner Burns Phillips. “They pay taxes into the state’s unemployment insurance trust fund and this will greatly reduce that tax bill.”

During the Great Recession in 2008, Tennessee’s unemployment insurance trust fund became insolvent due to a tremendous increase in unemployment claims. In an effort to ensure adequate funding to pay unemployment benefits, state lawmakers passed legislation that increased Tennessee’s taxable wage base from $7,000 to $9,000. The legislation also included provisions to reduce the taxable wage base when the trust fund was restored to an adequate funding level.

After six years at an elevated rate, in 2016 TDLWD reduced the taxable wage base from $9,000 to $8,000. That reduction resulted in a savings for employers, while continuing to grow the trust fund balance.

On June 30, the unemployment insurance trust fund balance continued to remain above $1 billion, which triggered the lowering of the taxable wage base to $7,000.00, effective January 1, 2018.

“Having the trust fund balance over $1 billion dollars is a milestone for Tennessee,” Commissioner Phillips said. “We weathered the recession better than many other states and now our trust fund has fully recovered from the hit it took during those difficult years.”

The Taxable Wage Base applies to all employers who pay quarterly state unemployment insurance premiums. Tennessee uses money from the trust fund to pay qualified claimants up to 26 weeks of unemployment insurance benefits.